Looking for collaboration for your next project? Do not hesitate to contact us to say hello.

Our solutions

The Smart Risk Suite

Power-up your advisory process with Smart Risk

Smart Risk is our modular and scalable solution, deployed in the Cloud or On Premise. The suite seamlessly integrates into your advisory process through APIs and web applications, relying on a connectivity platform to aggregate and consolidate all essential data sources (market, portfolio, etc.).

- 25-year R&D : Easy to use market-proven expertise

- Next-generation technology : Cloud and API technology to ensure a smooth and interactive user experience

- Modularity : Modular access to white labeled web apps, APIs and data connectors to fully integrate in your existing processes

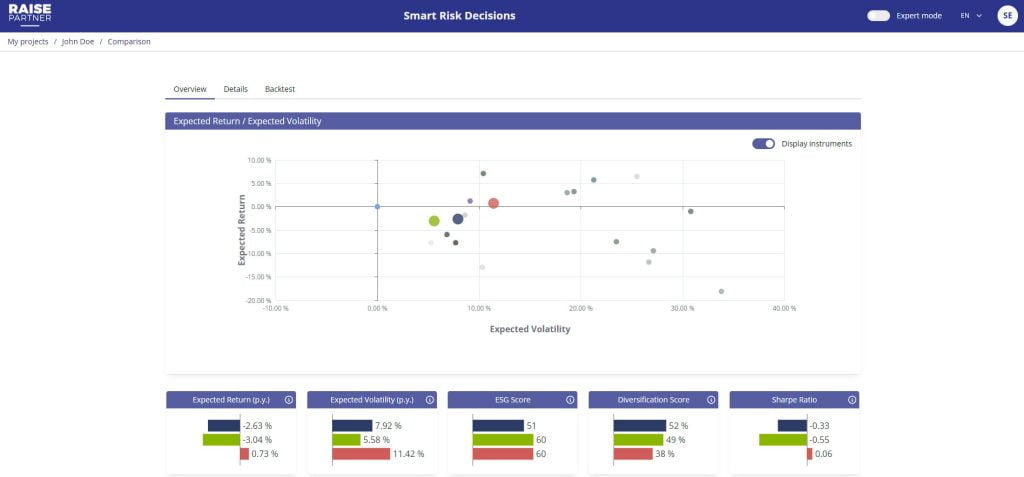

Smart Risk Decisions

Web application

Empower your advisors with a game changing web app to support the client/advisor relationship and deliver tailored and pro-active investment proposals

- Import of client assets (photos, files,...)

- Asset class mapping via our data partners (Morningstar, Burgiss, MSCI, Cambridge Associates, Sipa Metrics, EDHEC, SIX, and HFR)

- Cross-asset class overview.

- Risk and performance analysis on global wealth

- Suitability review

- Risk and performance contributions

- Historical and hypothetical market scenarios

- Backteting

- Trade simulations

- Forward simulations

- Before/after impact analysis

- Align portfolio with client’s objective, constraints and preferences

- Find the best trade-off on multiple criteria (risk, perf, ESG,…)

- Ensure compliance with client preferences and constraints

- Generate personalized investment proposals

- Provide a global wealth diagnostic

- Compare several investment proposals

- Generate custom reports

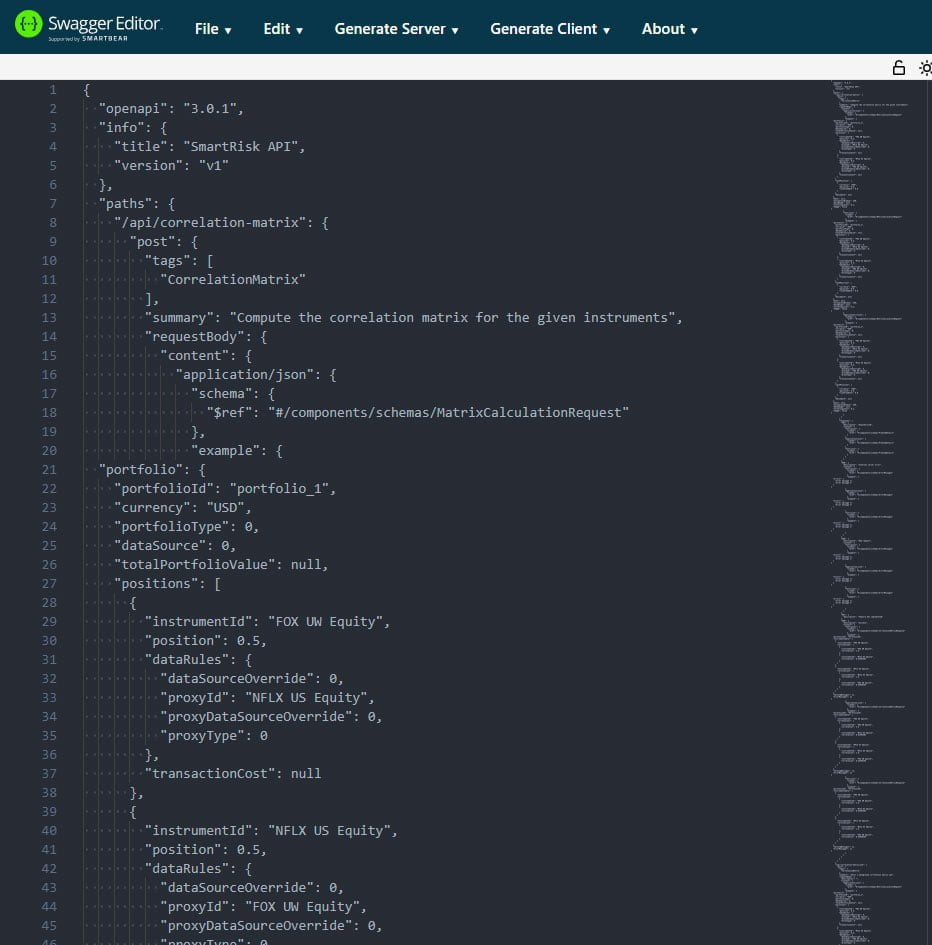

Smart Risk APIs

Integrate cutting-edge analytics and robust optimization in your advisory process

- Ex-ante and ex-post

- Cross-asset class risk modeling

- Risk measures: Volatility, VaR, CVaR, Max Drawdown

- Performance measures based on a historical approach or expert views

- Ratios: Sharpe, Sortino, Information, Traynor

- Factor analysis

- Robust portfolio optimization combining risk, return, ESG and regulatory constraints

- Extreme risk consideration (VaR, Max Drawdown,...)

- Multiple constraints: exposure, risk, performance, turnover, liquidity, regulatory constraints,...

- Hypothetical and historical stress-testing

- Consistent market scenario generation

- Backtesting

- SCR

- AIFMD

- PRIIPS