Looking for collaboration for your next project? Do not hesitate to contact us to say hello.

Our solutions

The Smart Risk Suite

Power-up your advisory process with Smart Risk

Smart Risk is a cloud-based modular solution designed to seamlessly integrate into the advisory journey. The Smart Risk suite consists of a set of modular APIs and web apps, as well as an underlying data connectivity platform to aggregate and consolidate multiple data sources.

- 22-year R&D : Easy to use market-proven expertise

- Next-generation technology : Cloud and API technology to ensure a smooth and interactive user experience

- Modularity : Modular access to white labeled web apps, APIs and data connectors to fully integrate in your existing processes

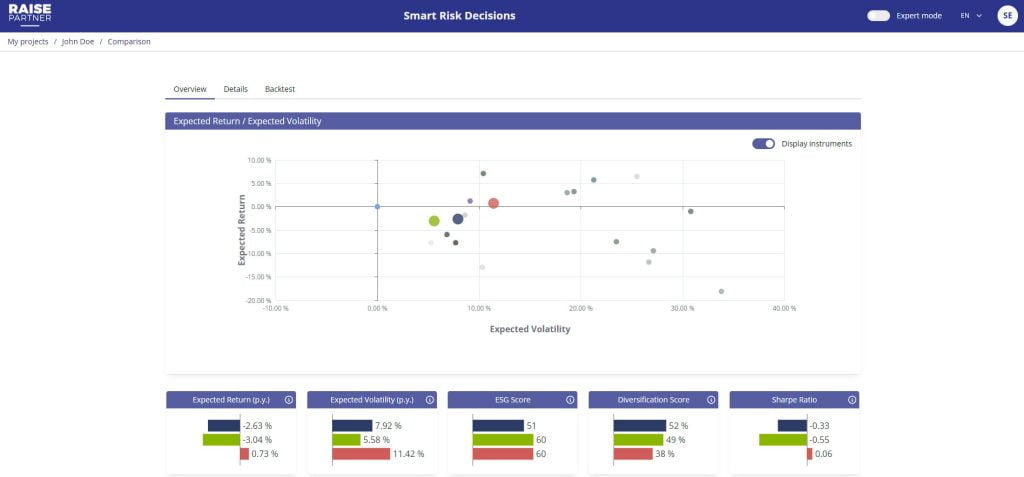

Smart Risk Decisions

Web application

Empower your advisors with a game changing web app to support the client/advisor relationship and deliver tailored and pro-active investment proposals

Interactivity

Onboard your end-client with an interactive discussion and a “4-hands” investment decision

Explainability

Beyond optimality, avoid the black-box effect: explainability and transparency are key to a trustful advisor/client relationship

Simplicity

Easy-to-use scenario simulation, impact analysis to understand the impact of investment decisions

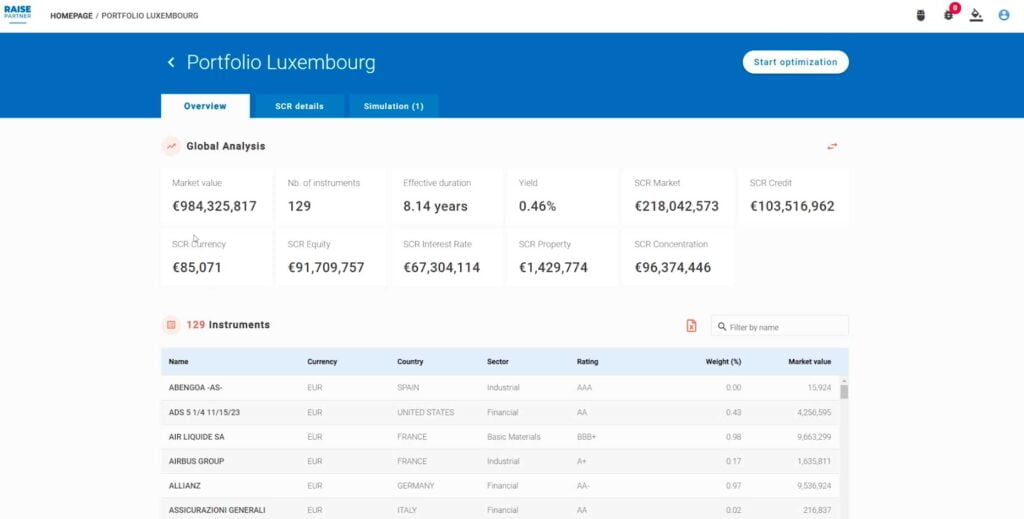

Smart Risk Decisions for Insurance

Web application

Equip insurance portfolio managers with a digital solution to support their investment decision in a complex regulatory and accounting environment

Interconnectivity

Connect to your internal or external Portfolio Management System for a consistent user experience

Leverage

Rely on internal expertise and data to feed our models and ensure consistency

Scalability

Run portfolio optimization on a large number of instruments and constraints on SCR, accounting, etc…

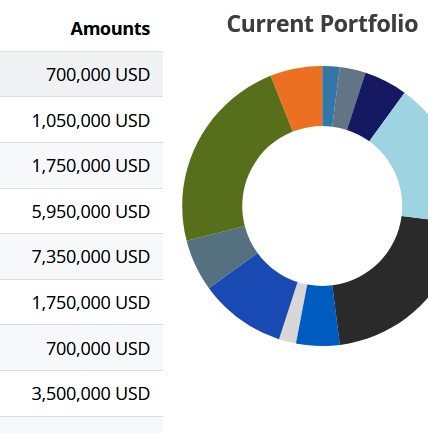

Smart Risk Decisions for Private Wealth Managers

Web application

Equip private wealth managers with a robust, intuitive, and ready-to-use application to support cross asset-class portfolio construction in an increasingly complex investment environment.

Turnkey Digital Solution

Access the web app instantly through an easy-to-use interface with built-in market data and no need for complex IT integration

Global Wealth Modeling

Model portfolios with a wide range of out-of-the-box indices across asset classes to get a global and unified view of the client’s wealth

High Value Features

Assess risk, simulate scenarios and optimize allocations across all asset classes in line with the client’s goals and preferences

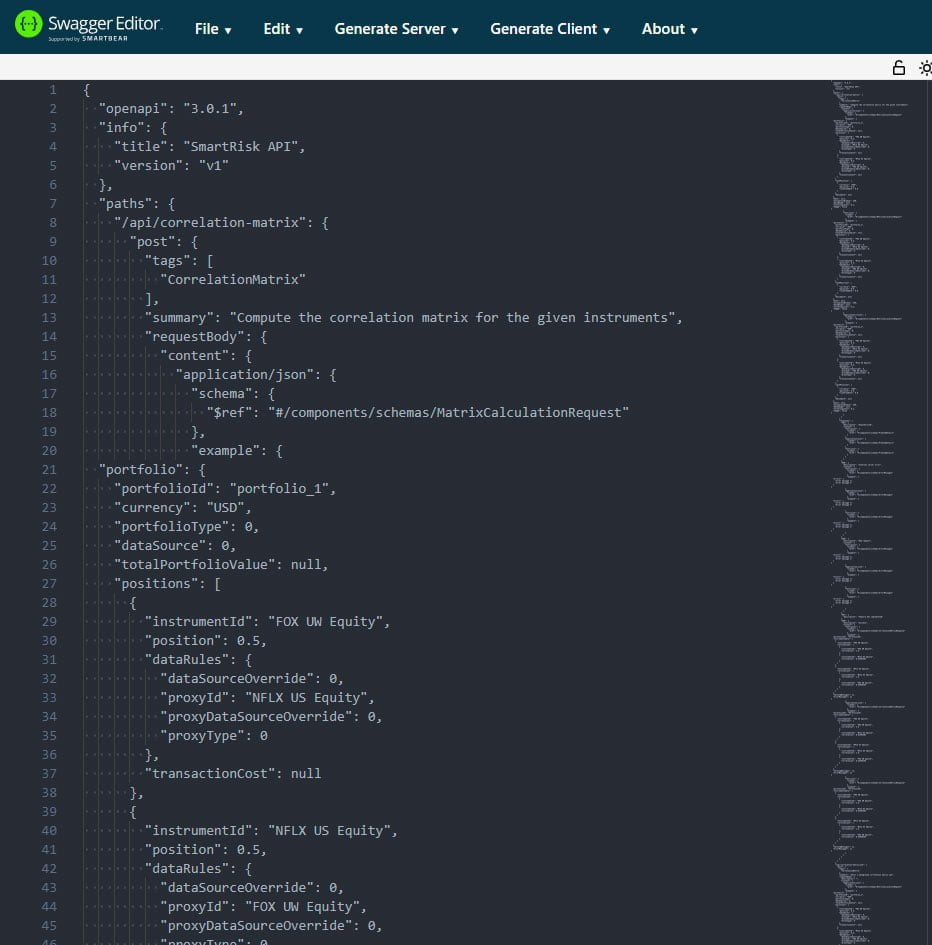

Smart Risk APIs

Integrate cutting-edge analytics and robust optimization in your advisory process

Risk and performance portfolio analytics

Robust portfolio optimization combining risk, return, ESG and regulatory constraints

Hypothetical and historical stress-testing

Consistent market scenario generation

Multi-factor portfolio analysis

Factor scan: optimal factor selection based on machine learning and clustering techniques

Regulatory risk: AIFMD, Solvency II (Market SCR), PRIIPS