Raise Partner is a Grenoble-based FinTech offering investment decision support solutions and applications for the private banking and asset management sectors. Earlier this year, Raise Partner decided to develop a dedicated Salesforce connector for its Smart Risk solution. The app will be available on Salesforce in a couple of weeks.

Why decide to make such an investment? Why choose to partner with Salesforce?

Sophie Echenim, President and CEO of Raise Partner, outlines the details of the partnership, and talks about her strategic choice to develop a dedicated connector to Salesforce.

Smart Risk, an invaluable aid to investment decision-making

The Smart Risk solution collects, aggregates and consolidates – in a 100% secure and anonymised way – data relating to its users’ portfolios to generate quantified analyses on which to base the best investment decisions.

“A few years ago, we made a shift from consulting to the development of APIs, to embed our technology and make it scalable,” explains Sophie Echenim. The aim was to make complex models accessible via a simple user interface.”

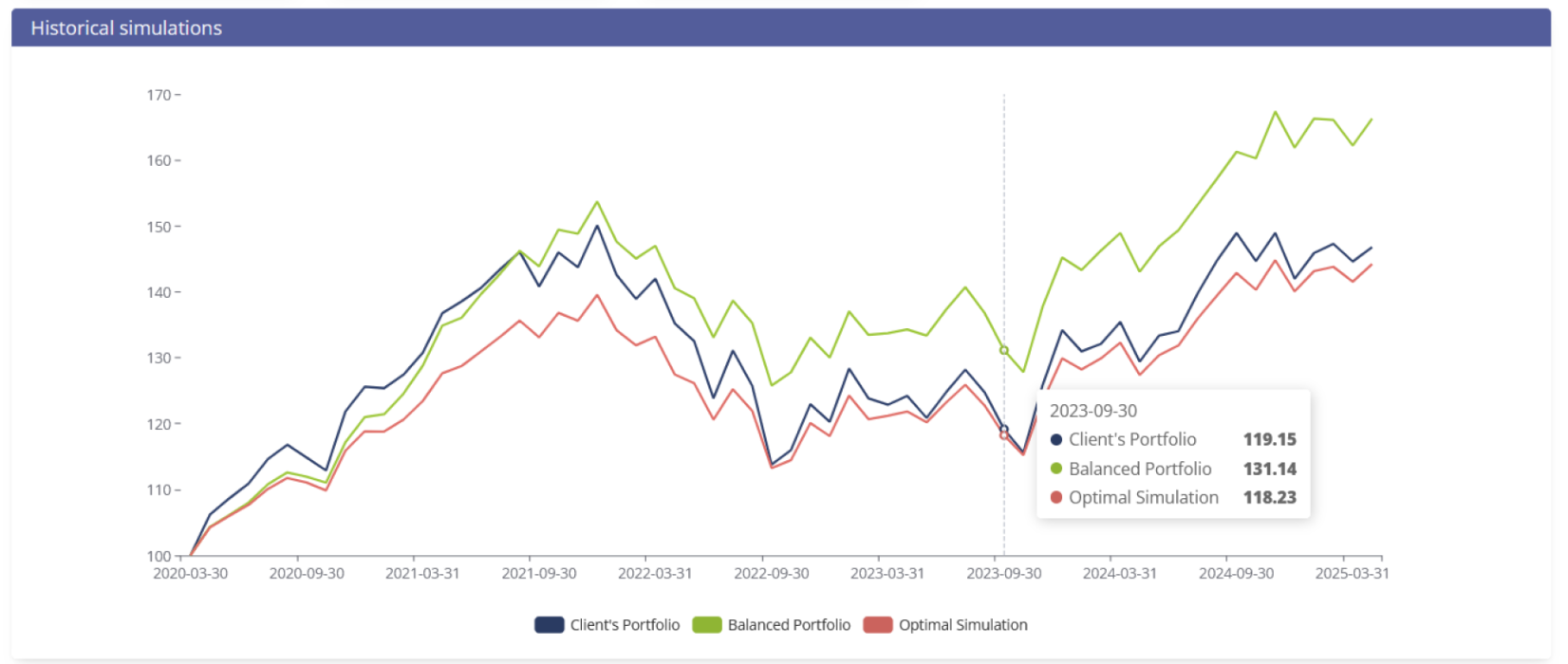

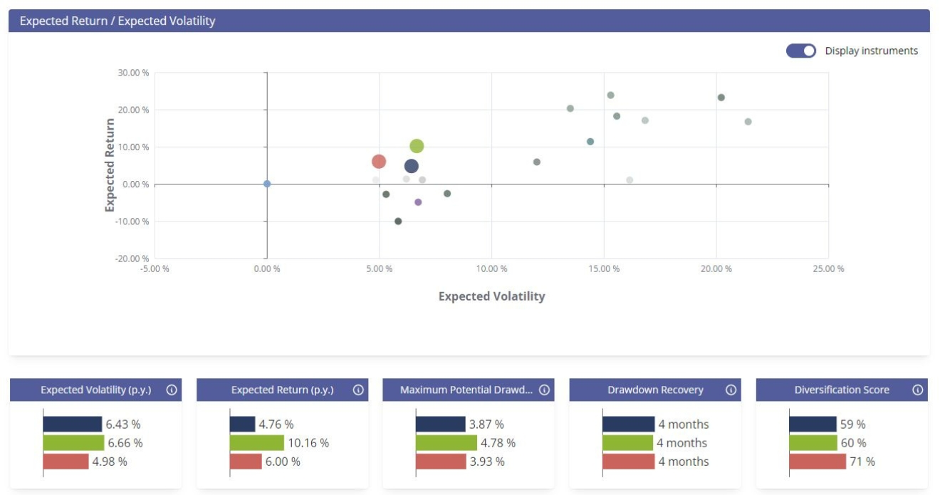

Figure 1 – Snapshot of Smart Risk Decisions web application: comparing the risk/return profiles of the client’s portfolio vs. two investment proposals

“Today, we offer several solutions in the form of APIs, which can be directly integrated into our customers’ solution ecosystems. We have also designed web apps dedicated to different use cases, notably for advisers working for private banks, which are integrated into their range of business tools on a white-label basis. This gives them access to our API functionalities through a simple, intuitive user path.”

The aim: to collect “raw” data and transform it into information that is directly usable, reliable and “smart” – in other words, with high added value.

Why develop a dedicated Salesforce connector?

“Our tool would effectively be useless if it didn’t have access to usable data,” says Sophie Echenim. This customer data is usually stored in a CRM (Customer Relationship Management) tool. Salesforce is one of the market’s leading CRMs, and is growing rapidly in the financial sector, with more and more private banks using it in Europe.”

“That’s why we felt it would be strategically interesting to be able to integrate our solution with Salesforce, especially since Salesforce customers use CRM in a very centralised way. This enables us to penetrate a new market, which would otherwise have been difficult for us to reach, and to offer a unified path to the end-user, who can now access all our functionalities from a single point of entry: the CRM they already use on a daily basis.”

A Salesforce connector opens the door to a substantial new pool of prospects for Raise Partner. And that’s just the beginning of the adventure:

“We will be continuously working to enhance our Salesforce app and connector to meet our clients’ evolving needs. We’ll also be taking part in Salesforce’s accelerator programme, which will support us in communicating and promoting the tool.”

How did you create a connector to integrate your solution with Salesforce?

“Our first task was to find the right partner, because we weren’t familiar with Salesforce technologies. We didn’t set out to form a dedicated in-house team, and the Salesforce ecosystem is very particular. It therefore seemed logical to us to turn to experts. That’s why we turned to Cloudity.”

“Expertise is the first criterion I take into account when choosing a partner for a strategic project,” says Sophie Echenim. “I was also keen to work with a company on a human scale, with whom we could share common challenges, and which offered real support. I didn’t want to go to a provider who would just bill me for man-days. I felt with Cloudity that we had a common interest in developing this business, and that we were aligned in terms of strategic issues.”

Building an application doesn’t just involve calling on technical expertise, such as web development. This requires a great deal of design work, to make the best use of what Salesforce offers its users in terms of features, functionality, and possibilities. There are also security, onboarding and other issues to take into account, which can be quite complex.

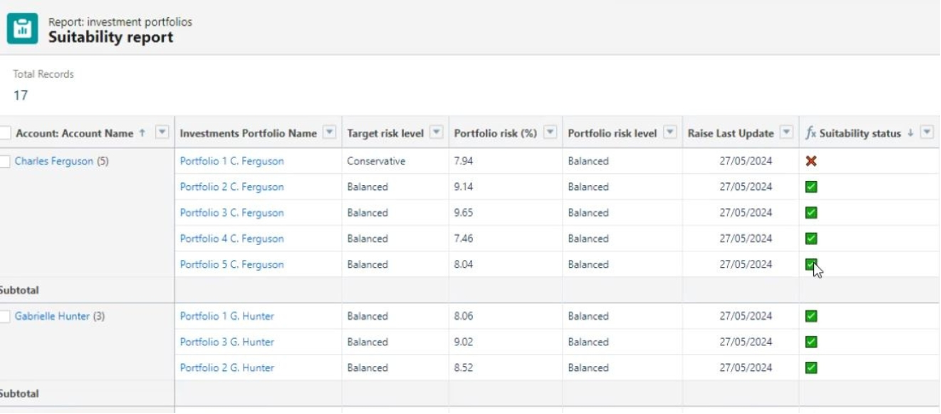

“Everything stored in Salesforce defines the customer’s investor profile (degree of risk aversion, performance requirements, etc.). The analysis of this data enables us to issue alerts when the customer’s portfolio deviates from its objectives. In a second phase, we will be able to retrieve the customer’s ESG preferences from Salesforce and make investment recommendations accordingly.”

Figure 2 – Suitability report in Salesforce powered by Smart Risk: detecting deviation from the client’s target risk profile

“While the mathematical algorithms we’ve developed are complex, our applications are intuitive and very easy to use, to help you make the right investment decision. We work exclusively in B2B, and our solution is in no way intended to “replace” anyone or to automate decision-making. Our aim is to equip humans, and to give professionals who are experts in these subjects the most qualitative data and analysis possible to enable them to make informed decisions.”

A Salesforce connector to meet the key challenges of the financial sector

In recent years, the financial sector has undergone significant regulatory change. The various players in this industry are therefore obliged to integrate new parameters to best support their customers in their investment decisions. Sophie Echenim chose to focus on three key challenges facing the sector today.

1. Personalised financial advice

“One of the main challenges facing our customers today is offer personalised financial advice, relevant to the needs of their client. Today’s private banks are ill-equipped to provide their customers with sound investment advice. With our technology, we enable them to move from a model where their consulting activity is no longer focused on the products they have to sell, but on the needs of their customers, thus (re)building a relationship of trust.”

“The starting point is the customer, her/his assets, needs and values. Only then do we make recommendations on the most suitable financial product, instead of starting from the product we want to “push” at that moment, by offering it to any customer.”

“It’s a profound paradigm shift that’s sweeping across the industry today, and Raise Partner’s aim is to support its customers in this evolution. With a solution like Smart Risk, we enable greater transparency and proactivity in advice – in other words, not waiting for a call from the customer, but contacting them to advise them on the right investment, on the right product, at the right time.”

2. Taking better account of customers’ ESG preferences

“We’ve also seen the emergence of extra-financial issues over the last few years,” confirms Echenim. “The customer profiles of the companies we work with are changing and they want to know the impact of their investments. This means taking into account ESG (environmental, social and governance) criteria, which are not linked to either risk or performance.”

Today, it is essential to be able to integrate these criteria, bearing in mind that this is now a regulatory issue. The European Union had already legislated in 2017 with the introduction of the NFRD – Non Financial Reporting Directive – which obliges companies with more than 500 employees headquartered in an EU country to carry out extra-financial reporting to track and publish the environmental, social and governance impacts of their investments.

With the CSRD (Corporate Sustainability Reporting Directive) introduced in 2024, and replacing the NFRD, the EU is requiring large companies (listed with over 500 employees and already subject to the NFRD) to carry out more demanding monitoring of their ESG performance.

This obligation is to be extended to large unlisted companies in 2025, then to listed SMEs from 2026, and to companies with at least one of the following criteria: more than 250 employees, a balance sheet in excess of €25 million or sales in excess of €50 million. The CSRD aims to :

· Standardise ESG reports on a European scale to make them easier to compare;

· Raising awareness of the risks associated with global warming;

· Increase the number of companies affected by these directives;

· Collect more reliable, accurate and complete information.

“That’s why it’s so important to integrate this notion into the advisory process,” confirms Echenim. “Today, it’s essential to know a customer’s profile, preferences and sensitivities, so as to be able to make investment proposals in line with their values.”

3. Use reliable, smart data

Which brings us to the third key issue facing the finance sector today: Data.

“Today, all advisory and decision-making models are based on increasingly rich but not always highly structured data. The ability to analyse, aggregate and consolidate this data into ‘smart data’, which can be used directly, is a third essential challenge for all those involved in finance today,” continues Echenim.

Developing a Salesforce connector: Sophie Echenim’s two tips

Are you a software publisher looking to support your growth by targeting prospects in the Salesforce ecosystem? Discover Sophie Echenim’s advice and what she learned from working with Cloudity:

“My first piece of advice is to work with industry experts, and not to assume that you’ll “manage”. For me, it’s essential to work with people who have in-depth knowledge of the Salesforce ecosystem. So we have to make the choice to invest and put our trust in a partner who will bring us credibility.”

“Secondly, I’d advise starting with a limited MVP (minimum viable product), and not going straight into six months of development. Instead, develop a first application and test the market as quickly as possible, to fully understand how to successfully go-to-market on Salesforce.”

About Sophie Echenim & Raise Partner

Raise Partner is a Grenoble-based fintech with over 20 years of innovation behind it, which has developed mathematical models to provide an investment decision-making tool for financial portfolio managers, private banks and others. The solution enables these different players to advise their customers on investments to be made, risk management, ESG preferences and so on.

Initially a researcher, Sophie Echenim joined the Raise Partner team at the very beginning of the adventure: “I’ve been head of Raise Partner since 2016, but I joined the company in 2002, shortly after the project was launched. I have a scientific background, as I started my career in R&D, then became interested in the use cases for our technology. That’s when I was asked to take over the management of the company.”

About Cloudity

Cloudity, a pure player in Salesforce – the market-leading CRM – and an expert in consulting and implementation, supports its customers worldwide in their integration of Salesforce technologies.