Looking for collaboration for your next project? Do not hesitate to contact us to say hello.

We’re here to answer any question you may have.

Looking for collaboration for your next project? Do not hesitate to contact us to say hello.

We provide analytics and portfolio construction tools to support investment decisions. We equip advisors, wealth managers and sales teams with interactive web apps to help them build proactive, personalized and transparent investment proposals for their clients.

We equip private banks and Family Offices with interactive and scalable web applications to support high-end high-touch advisory, from suitability monitoring to personalized portfolio construction. We help them scale their ability to provide personalized services to their UHNW to mass-affluent clients.

We support sales teams and distributors with digital tools to design tailored investment proposals and run targeted and client-centric marketing/distribution campaigns. Smart Risk is used to support client-centric investment proposals for both institutional and private clients.

We also help investment banks and insurance companies in their investment value chain, contact us to learn more.

Augment advisors and sales teams with a game-changing web app to support client relationship and deliver tailored and pro-active investment proposals

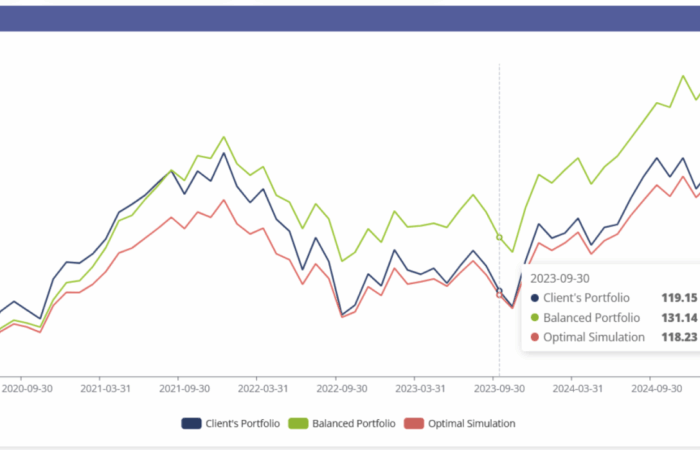

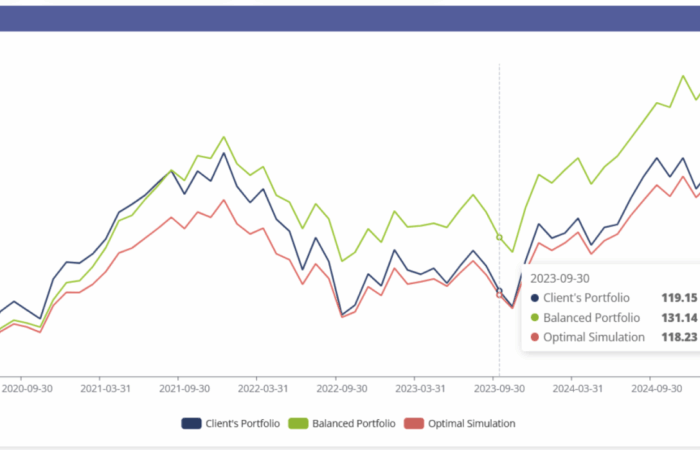

Evaluate the impact of investment decisions on risk, performance, ESG criteria and bring more transparency to the end investor

Run simulations, what-if scenarios in client-facing situations to onboard the end client in the investment decision process

Access cutting-edge portfolio analytics and portfolio construction features through an easy-to-use, easy-to-adopt web app

Scale up as your business grows thanks to cutting-edge technology and analytics engines

We use our 22-year expertise to serve our customers, deliver high added-value solutions, with a constant commitment to quality and customer intimacy.

We are always looking for the next best idea in the optimization and AI research spaces as well as in next-generation technologies to better serve decision makers.

We foster team spirit internally as well as with our clients and partners to unlock creativity and address together technological and business challenges.

Adding {{itemName}} to cart

Added {{itemName}} to cart